Federal taxes are not the only taxes you have to pay attention to. Ignoring state taxes can lead not only to a significant increase in the tax burden, but also to serious penalties at the state level. The main types of taxes in this area are Corporate Income Tax, Franchise Tax and Sales tax. Let’s look at each of these taxes separately to better understand how to deal with them.

Corporate Income Tax, levied at the state level, is analogous to federal income tax. There is no such tax in Nevada, Washington and Wyoming. In different states, and depending on the amount of profit, the rate of this tax ranges from 1 to 12%.

The tax is levied on the net profit received from conducting business in the territory of a separate state. In general, net profit is calculated on the basis of the amount of net profit calculated for federal income tax purposes, which is adjusted in accordance with the tax laws of the relevant state.

Franchise Tax is a type of state tax. The amount of tax may depend on profits, revenues, assets, and the number of shares issued by legal entities. In some states, the amount of tax is a fixed fee that is levied annually.

The states of California and New York do not have Corporate Income Tax, but Franchise Tax is calculated in the same way as Corporate Income Tax is collected in other states. Since state taxes are levied on the basis of the company’s relationship with the state (in the case of Corporate Income Tax, it is a state business), in the case of Franchise Tax, one of the following four conditions may lead to this tax:

- the company operates in the state;

- has business units in the state;

- is registered in the state;

- is licensed to operate in the state.

For legal forms of business that have the status of transparent, in most states the taxation procedure is similar to the federal level, but some states automatically apply the status of corporations to them.

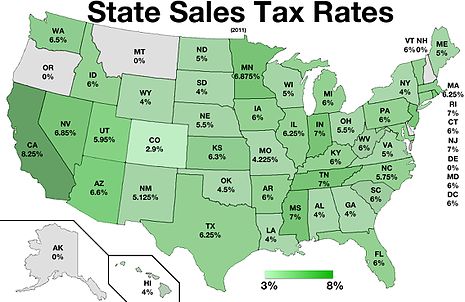

Sales tax can be:

- Retail tax: A tax levied on retail sales. It occurs when goods are sold to the consumer.

- A tax levied on the right to sell goods within a state. Paid by the person who sells the goods and actually pays for the permission to sell within the state. Charged according to the volume of sales;

- Turnover tax. It is analogous to the tax levied on retail sales. However, the tax base is quite broad, and also includes the provision of certain types of services and the sale of intangible assets.

If you want your taxes to be handled by professionals, you can use this company, which specializes in tax preparation tucson az https://southwesttaxassociates.com/. Many corporations trust tax preparation to such companies, as it guarantees them high quality of work. The country’s tax system is quite complicated, so the opportunity to transfer this work to a reliable company can be a great choice.